The Weekenders: How Much House Can You Afford?

Kim McGalliard | June 22, 2012

Since houses in upstate New York come in all sorts of shapes, conditions and sizes, for some people it’s easier to start with a criterion that is less flexible than what type of house you want or where you want it to be: how much can you afford to pay?

Back in the olden days (say, 2002-2007) banks were free and easy with their money. It was relatively easy, even with bad credit, to only put 5% or 10% down on a house and you could get a loan at a fairly reasonable interest rate. We all know how that ended, so banks now are much more strict about whom they lend to and how much they will let you borrow relative to the appraised value of the house, especially on second home mortgages. The good news is that interest rates are really low right now; according the New York Times, the average is 4.06% for a 30yr fixed rate mortgage in New York. Your credit, income and other assets will affect the rate that you get, but that’s almost free money!

The other good news is that, in general, house prices have dropped then stabilized (other than in NYC), so if you can, now is a great time to buy. So before you start searching real estate sites for the perfect house, take some time to figure out how much you can realistically afford. In order to start your search, you need to find a dollar range — the maximum you CAN pay and a minimum you WANT to pay. Start with the down payment: how much cash do you have in your savings account — without cashing in 401Ks or borrowing from family? Banks request information about the source of any down payment, so ideally your down payment is cash you’ve saved and have on hand. Take this number and multiply it by five. The result is the amount you can afford if you put down 20%. Most banks these days won’t take anything less than a 20% down payment, especially if it’s a second home.

For example, let’s say you’ve been a good little saver, you’ve been making your own coffee instead of buying Starbucks, and you’ve been brown bagging it to work, and you’ve socked away $30,000. This would be a 20% down payment on a $150,000 house. There are multiple good mortgage calculators available on the web. Bankrate.com has several, if you can find your way around the ads. Using their standard mortgage calculator and a conservative guess at an interest rate of 4.5%, the monthly payment on a $120,000 mortgage would be $608.02. Seems pretty reasonable, no?

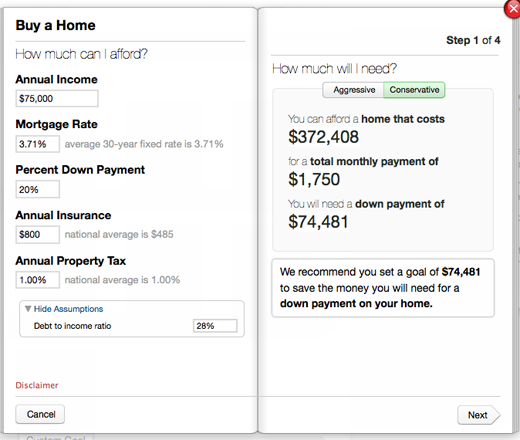

The amount of savings you have on hand may dictate the maximum you can spend now, but you can also be more aspirational and save more money so you can afford more home. Mint.com, a money management site, has some really great tools for both budgeting and planning for large purchases. If you aren’t familiar with Mint.com, it allows you to tie any number of bank or credit card accounts to the site so you can actively track your purchases. You don’t use Mint.com to make any payments, but depending on how much information you provide, it can give you a really full picture of where your money is, where it goes and how much you actually spend on beer each month. It can be very illuminating.

Besides budget tools, they have a “Goals” tool (pictured obove) that helps you determine how much you can afford to pay for a house and estimates either by the amounts you save or by computed date, how long it will take you to get there. You can link it to one or more savings accounts and it will track how close or how far you are from your goal.

Once you’re ready to start your search, it’s always a good idea to get either a pre-qualification, or better yet, a pre-approval, ideally from a local bank that knows the area you are looking in. The difference is that with a pre-approval, you go through the steps of actually submitting information and paperwork to the bank and they give you a real commitment to lend money to you. A pre-approval can make a huge difference when you start working with real estate brokers – they know that you are serious about buying a place and they will work harder to help you find what you’re looking for. It will enable you to put in a bid on a place and have the seller take you seriously as well. If you do happen to have a bidding war (a common thing in NYC, a not very common thing upstate) a pre-approval may give you a leg up on your competition.

Of course, there is no guarantee that a bank will agree to loan you money. Especially for second homes, you may have a harder time getting approved. If you do get a mortgage for a home that you can’t claim as a primary residence (one that your bank agrees you can commute or work from), there may be certain provisions in your mortgage agreement that preclude you from using the property in certain ways – either renting it out or using it specifically as an investment property. If you’ll need to use your property as an income generator to cover all or part of the mortgage or other fees, make sure you negotiate with the bank to allow you to do this. The bank may make you pay a higher rate or put more money down. It often makes sense to work with a mortgage broker to help you find a bank that will give you the best rate and terms for what you want.

Obviously, beyond the mortgage, you will eventually need to figure in your additional monthly costs, but these will be specific the house you buy:

- Insurance: you’ll need property insurance and depending on where a house is in relation to flood zones, federal flood insurance. Unfortunately, it’s really difficult to get estimates for insurance costs unless you have a specific property in mind and you are willing to put some personal information into web sites to get information.

- Taxes: worthy of an entire post on their own, partly because they are confusing and partly because they are important. New York has some of the highest property taxes in the country, and counties just north of the city have some of the highest in the state.

- Utilities: Electric, oil, gas or propane (or wood) for heat. Unless you purchase a house with a well and/or septic system (generally outside of towns or villages) you’ll need to include water and sewer charges as well.

- Transportation: unless you can find a car free location, you’ll need a car (along with insurance) to get there and to get around while you’re there. If you’re planning on any DYI work, a truck or van might be required.

- Maintenance and repairs: Ideally, especially if you buy a new place or one that has been recently renovated, you won’t have to worry about this for a few years. Our first three months at our place, the boiler and hot water heater went out a few times. We had to call our “energy provider” (MainCare, which we actually really like and are happy with) to come for service calls. Because we we’re only here on weekends, they charged us a weekend rate of time and a half. They told us that if we got a service agreement (about $250 a year) they wouldn’t charge us extra to come out on weekends. We forked over the cash. Of course we haven’t had a bit of trouble since. But, at the same time, service agreements can be a life saver if you have a big failure – they’ll fix many things for free and they’ll do a cleaning and annual service as part of the agreement.

Some people find different ways to help supplement their country home by sharing with other people (just make sure you work out the legal issues of who owns what), renting for certain weekends or months during the high season, or getting a fixer-upper. It is cheaper to live upstate than it is to live in the city, so if you can’t afford to keep two places, you can always move upstate permanently. But good luck finding a job, or getting decent internet service so you can work remotely.

Read On, Reader...

-

Jane Anderson | April 1, 2024 | Comment A Westtown Barn Home with Stained-Glass Accents: $799.9K

-

Jane Anderson | March 25, 2024 | Comment A c.1920 Three-Bedroom in Newburgh: $305K

-

-

Jane Anderson | January 30, 2024 | Comment A Renovated Three-Story Beauty in Poughkeepsie: $695K